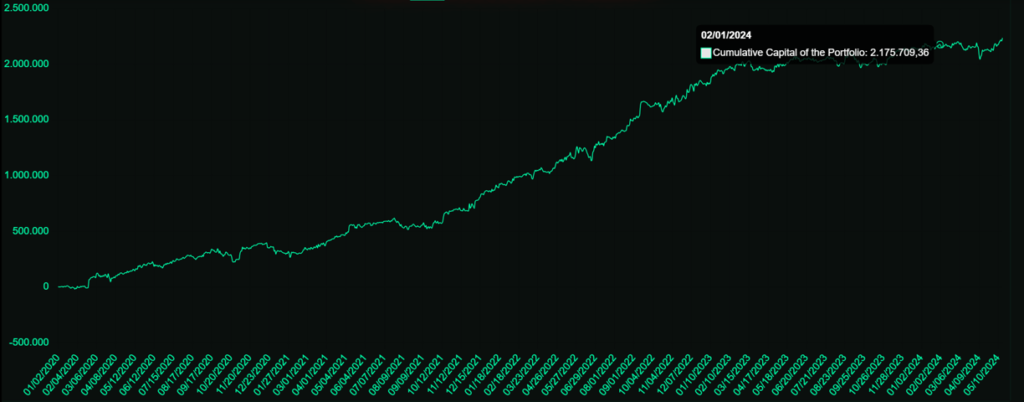

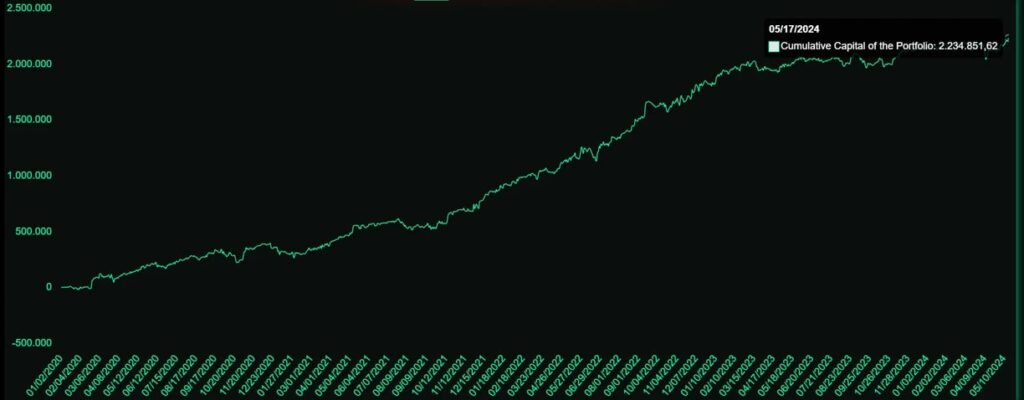

The portfolio was created on January 31, 2024, with an initial value of 2,175,709.36. As of the close of yesterday, May 17, 2024, the portfolio’s value increased to 2,234,851.62. This means the portfolio has experienced growth over this period.

The portfolio was created on January 31, 2024, with an initial value of

Calculating the Profit

To find the profit obtained:

- Initial value on 01/31/2024: 2,175,709.36

- Final value on 05/17/2024: 2,234,851.62

Profit obtained = Final value – Initial value

Profit obtained = 2,234,851.62 – 2,175,709.36

Profit obtained = 59,142.26

Calculating the Return Percentage

Now, let’s calculate the return percentage based on an initial capital of 800,000.

Return percentage = (Profit / Initial capital) 100

Return percentage = (59,142.26 / 800,000) 100

Return percentage ≈ +7.39%

It is important to highlight that this has also occurred in an environment where we have increased the price of licenses.

I encourage all those who invest using this strategy to select systems with several years of verified track records to increase the chances of success. This is just an example, and this portfolio can be greatly improved by diversifying with systems from other developers that have shown consistent performance. Do not rely on what I am saying here. Verify it for yourselves.

At the end of the year, we will analyze the portfolio and aim to maintain the same number of units while increasing their variety to further diversify. Let’s remember that we are looking for systems that have performed well for at least four years.