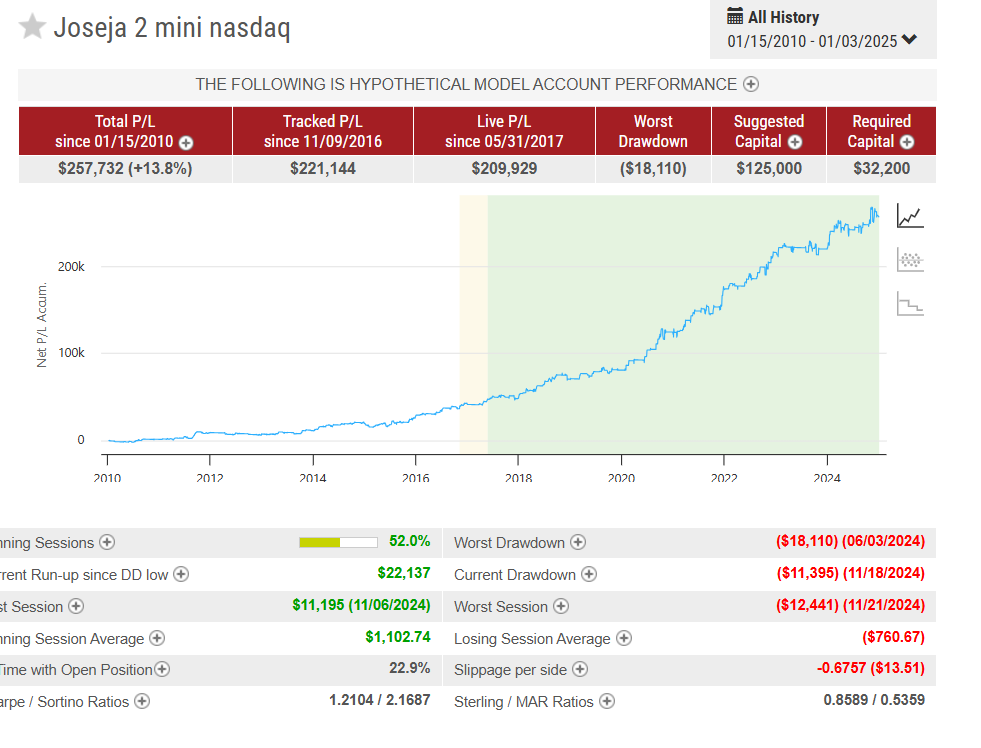

What is the probability that a system with 8 years of outperforming the market will continue to do so? I wish I had that exact answer, but I can say that, for now, it’s the best system available.

It is currently experiencing a drawdown of $11,395, and on Friday it triggered a long entry in the Nasdaq.

The most favorable environment for this system is an upward-trending market (though it also takes short positions).

In a previous article, we explained that a short- to medium-term investor should not tolerate more than double their maximum drawdown, set at $36,040

Advantages

– The best track record available

Disadvantages

– Psychologically challenging and requires iron discipline

If you’ve been waiting for a good time to enter, this is a very attractive opportunity, as the Nasdaq is in a strong uptrend and the system is already positioned long. To maximize its potential, it’s best to activate it right away instead of waiting for the next trade, given that the current market environment is particularly favorable.

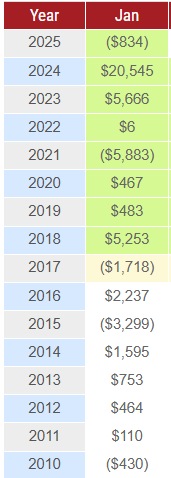

Historically, the results of Joseja 2 mini Nasdaq in January have been as follows:

It’s important to stress that waiting for the next trade is not advisable, as the current environment and the possibility of repeating a strong January like last year call for immediate activation. If the trend continues, we could see a very positive month.

The arrival of Donald Trump at the White House creates a fairly optimistic scenario for these types of strategies.

And remember, trade like a bot.

If it fails to break the 21600 resistance and goes short at 21200, would it be better to disable the system and reactivate it when it goes long again on the second attempt at a breakout?

The temptation to focus solely on long positions, based on their historical profitability and the Nasdaq’s performance, is understandable. However, it is essential to review all the figures: in 2022, the Nasdaq retreated more than 30%, while this system achieved a gain of $43,815—equivalent to 35% of the current suggested capital of $125,000. In 2018, the Nasdaq fell 3%, while this system gained 17.5%. Technical analysis relies on historical data, and uncertainty is normal when investing in these instruments, as there is no record of a system that has beaten the market for 20 consecutive years. Algorithmic trading is maturing, and the evolution of these systems has never been shown so transparently. It is your responsibility to analyze the numbers thoroughly. I am also learning as the market evolves.

2017 and 2021 were both post election years with transition years with January as a loosing month. Just observing. But my question would be if a trader should consider getting out of markets in transition periods?

I wouldn’t exit the market during those periods. Adjust your positions, use hedges and stops, but don’t step away entirely: there are also opportunities in transitions, unless for some reason you don’t feel comfortable trading in those years.

Thanks Javier. So far the trade looks great!

Hi Javier,

Joseja 2 mini Nasdaq made new high with best session ever on 01/27/25 (ironicaly it was the deepSeek short!).

Now Mini SP ES Jk is almost at it’s max DD, how would Mini SP ES Jk compare or compliment Joseja 2 mini Nasdaq. Much less capital tied up and less DD.

Are they very similar in trading style? Maybe it’s better off taking 2 unites of Mini SP ES Jk instead of Joseja 2 mini Nasdaq.

If you can write blog about Mini SP ES Jk that greatly be appreciated.

Thanks!

Hi Daniel,

No problem, I will write an article about Mini SP ES Jk. However, I want to clarify that I’m not a fan of changing systems unless it deviates from its normal levels. I would only consider adding more systems if handling Joseja 2 Mini Nasdaq becomes easier for you.

As you can see, Joseja 2 Mini Nasdaq can be psychologically challenging, especially during drawdowns or unexpected movements. My recommendation is to become more familiar with it before adding new systems. Don’t rush; when you feel comfortable with the operation, that will be the time to consider more options.

For now, Joseja 2 Mini Nasdaq is the system that has shown the most consistency in long-term profits. It has been profitable in real trading for 8 years, and I haven’t changed any of its parameters, nor will I. I won’t deny that this system has an original style and is somewhat complicated. That’s why I always say you need to have iron discipline.

Best regards,

Javier

Hi Javier,

I was wondering what’s your opinion on why it seems that a lot of systems are not performing well. Has anything drastically change in the market in terms of trading?

Hi Daniel,

Market conditions have been highly volatile since Donald Trump’s victory. While I had anticipated a more favorable scenario, the combination of index declines and erratic movements has created an environment of uncertainty that may temporarily impact many trading systems, especially those designed to operate in more stable trends. Although I believe the market will eventually stabilize, it is essential to exercise extreme caution in the short term.