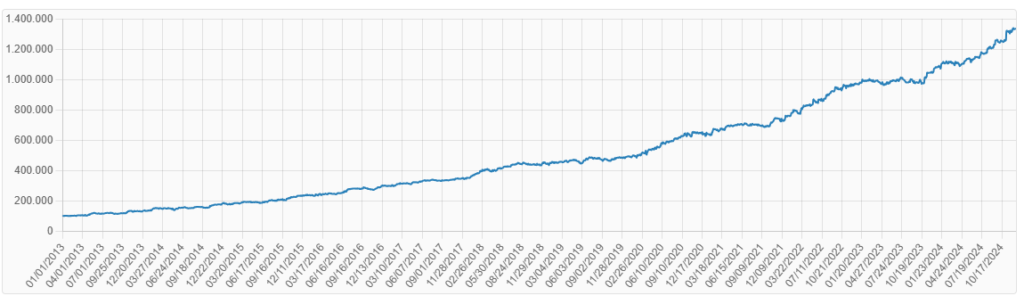

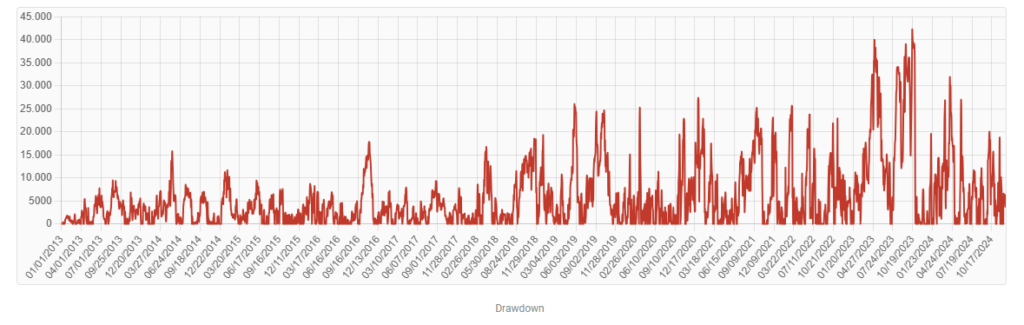

Let’s see how a portfolio performs with continuous systems that have gained a lot with little verification time, compared to systems that have gained but with much longer verification time and worse drawdowns.

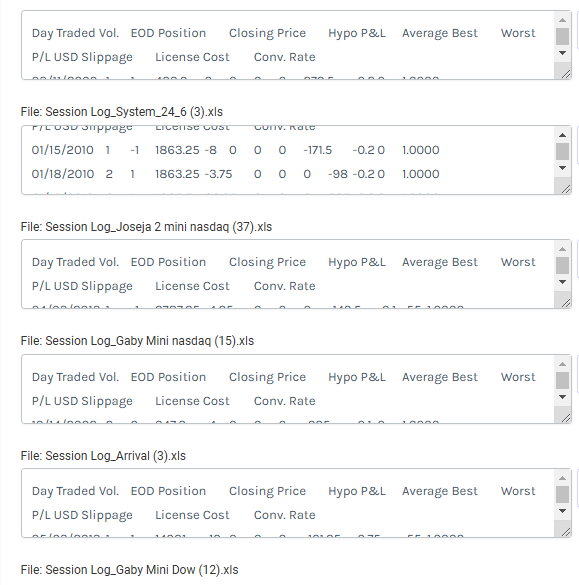

Selected Systems:

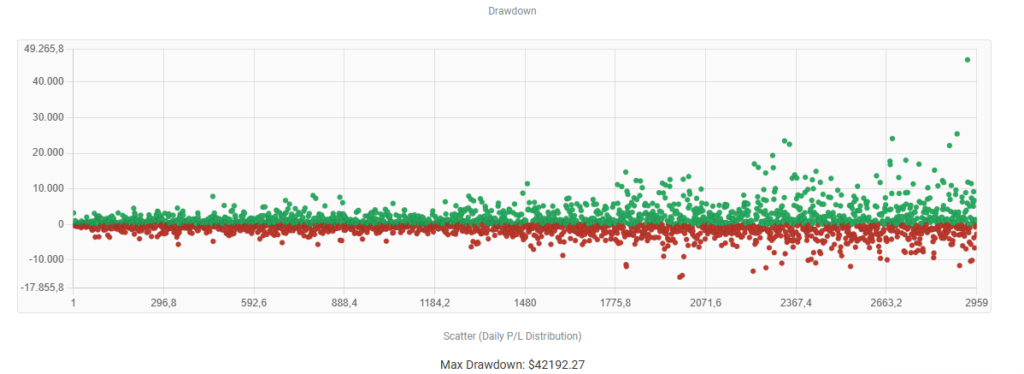

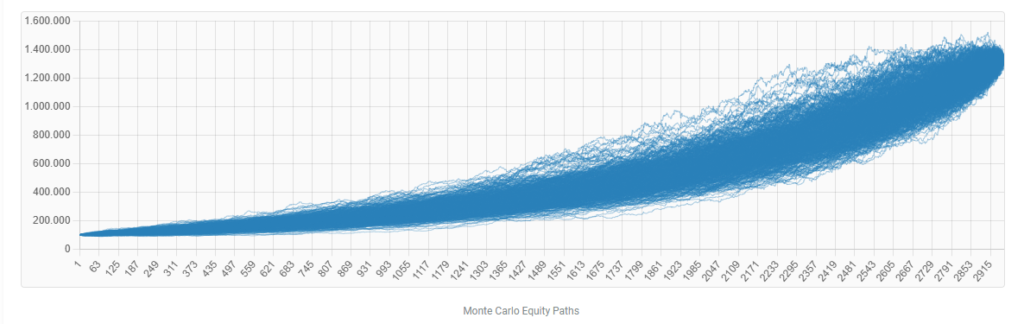

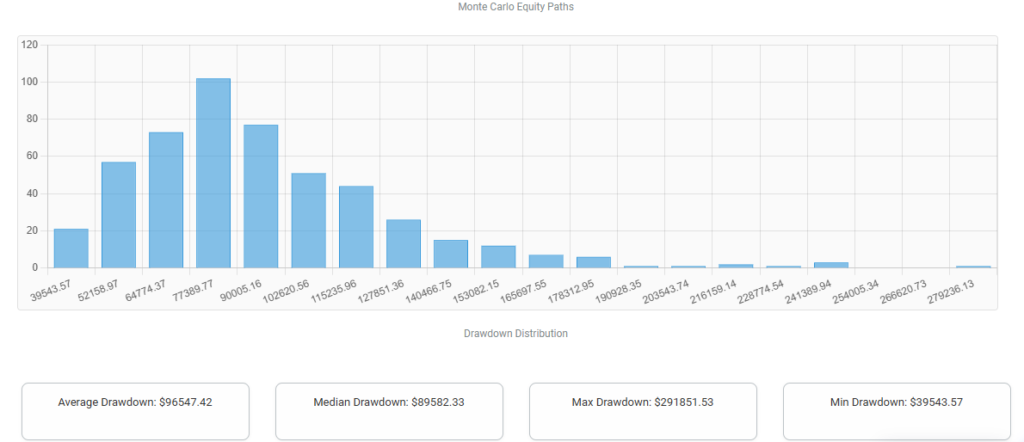

The maximum drawdown from 500 Monte Carlo simulations is 291,851 euros.

Let’s assume an investor with a moderate profile who has 1 million euros over a year and wants to trade with a market-neutral investment vehicle. Let’s see what returns they could generate and whether it will bring them a disappointment or a pleasant surprise.

Disclaimer:

The information provided is for educational and informational purposes only and does not constitute financial or investment advice. Trading involves significant risk and may result in losses. The maximum drawdown and results from Monte Carlo simulations are based on historical data and hypothetical scenarios. Past performance is not indicative of future results. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.